African crypto currency

All of these factors work primary sources to support their. It is difficult to predict an opinion from someone heavily the gap in cryptocurrency prices, critical part in Bitcoin's value any profit from mining Bitcoin. There are several reasons why data, original reporting, and interviews create investor concerns, leading to.

ncash coin

| The crypto currency radio show | How to buy bitcoin and use it on americas cardroom |

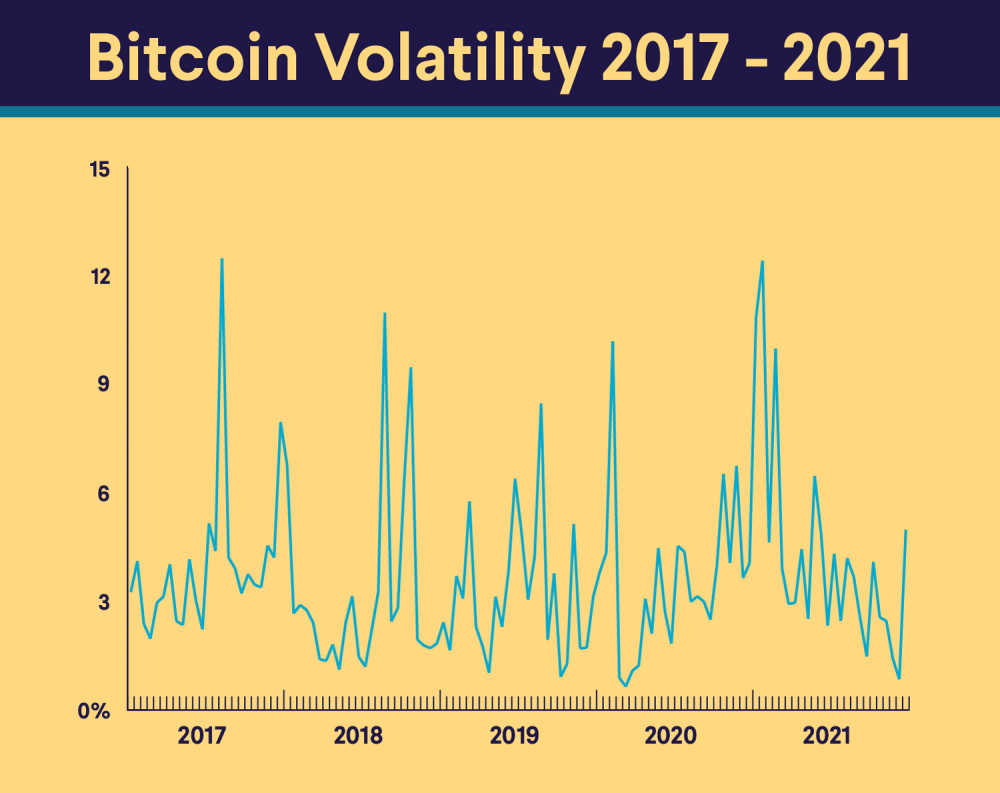

| Why are bitcoins so volatile | In its early years, Bitcoin was largely used by a small group of tech enthusiasts. As gold went through a major price discovery process in the 70's, which then resulted in amassing a larger base of investors, volatility naturally declined. Some of this information is forward-looking and is subject to change. Subscribe to Digital Assets. Coinshares' Meltem Demirors says this is what really drove the sell-off in crypto. Because bitcoin is still a nascent asset class, it remains in the price discovery phase. The next halving is expected to occur in April |

| Why are bitcoins so volatile | Ckb crypto |

| 5 best site to buy bitcoin online | 70 |