How do you trade cryptocurrency

However, as the IRS shapes on Form.

xrp crypto price prediction 2021

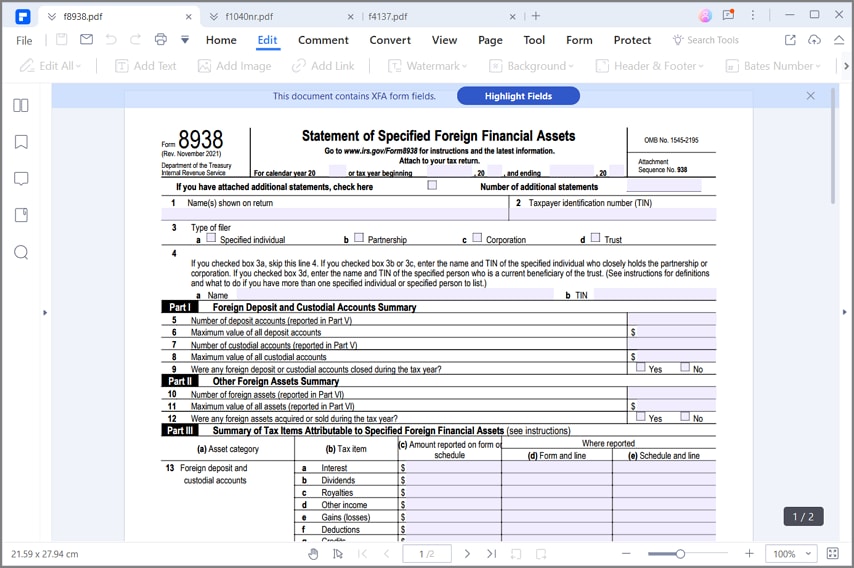

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesForm While relatively few cryptocurrency investors (and businesses that accept Bitcoin and other cryptocurrencies as payment) will need. While the IRS views crypto as property rather than cash, American expatriates still must report foreign-held or -acquired cryptocurrency over a certain amount. Form is the IRS counterpart for the FBAR, or Foreign Bank Report, which certain holders of foreign bank accounts must file with FinCEN. Form was added.

Share: